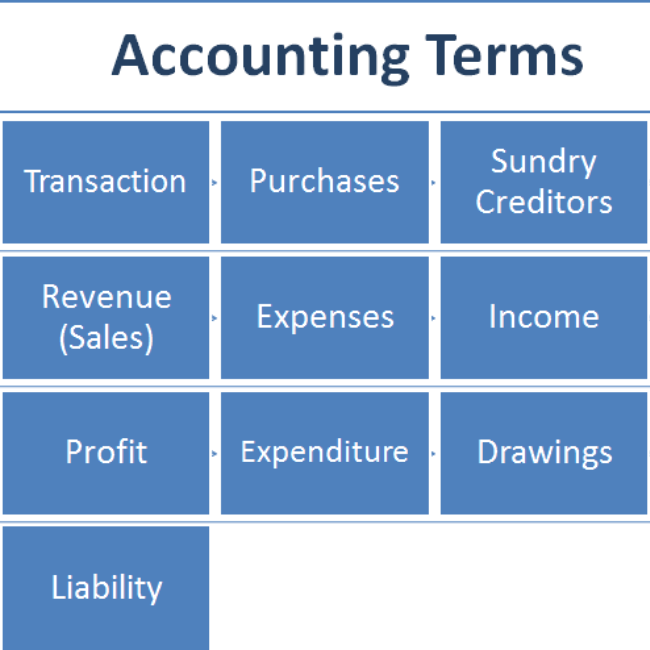

Basic accounting terminologies

$3

Use, by you or one client, in a single end product which end users are not charged for. The total price includes the item price and a buyer fee.

Resource Description

In this resource we learn about basic accounting terminologies such as transaction, and it’s classification as cash transaction and credit transaction, meaning for an account and it’s classification as assets, liabilities, owner’s equity, expense and revenue. Also the difference between assets and liabilities is analyzed. Detailed discussion for the various source documents such as voucher, invoice, pay in slip and cheque have also been made. The meaning for the terms debtor and creditor, as well as the difference between the two is presented in a simpler way. The other terms relating to drawings, purchases, purchase returns, sales, sales returns, solvency and insolvency have also been taught with examples wherever required to make you get a clear understanding. The difference between debit note and credit note which were used respectively in sales returns and purchase returns transactions was also discussed. Finally the meaning for gross profit and net profit is also explained with formula and the difference between the two. By going through this resource you will definitely get a good understanding about various accounting terminologies. We will present the same in bullet points:

- Transaction classified as cash transaction and credit transaction

- Account classified as income, expense, asset, liability and owner’s equity

- Difference between assets and liabilities

- Voucher, invoice, pay in slip and cheque

- Drawings

- Purchase, purchase returns

- Sales, sales returns

- Difference between debit note and credit note

- Debtor and credit

- Solvency and insolvency

- Profit classified as gross profit and net profit

KES(KSh)

KES(KSh) USD($)

USD($) GBP(£)

GBP(£) GHS(₵)

GHS(₵) NGN(₦)

NGN(₦) MUR(₨)

MUR(₨) BWP(P)

BWP(P) AUD($)

AUD($) TZS(Sh)

TZS(Sh) INR(₹)

INR(₹) PHP(₱)

PHP(₱) AED(د.إ)

AED(د.إ)